DENIC als führender Anbieter und globaler Treuhänder im Digital Escrow kennt die Wichtigeit von Kontinuität Ihrer unternehmenskritischen Daten jeglicher Art. Deshalb sorgen DENIC Experten-Teams jeden Tag dafür, dass Ihr Geschäftsbetrieb auch in unvorhergesehenen Situationen reibungslos weiterläuft. Das Fachwissen in Bezug auf Digital Escrow Vereinbarungen bietet Ihnen umfassende Sicherheit und zuverlässigen Schutz für Ihre wichtigen Daten.

Was ist Digital Escrow?

Digital Escrow ist eine Dienstleistung (Treunhand Hinterlegung), bei der ein Drittanbieter (Hinterlegungs-Treuhänder) Daten und digitale Dokumente egal welcher Art oder sogar ein gesamtes geschäftskritisches Software-System verwahrt und sicherstellt, dass diese Dateien bei einem bestimmten Ereignis (z.B. einem Konflikt zwischen dem Software-Eigentümer und dem Software-Lizenznehmer) zugänglich sind. Der Zweck von Digital Escrow ist es, die Abhängigkeit des Kunden zu reduzieren und den Interessenkonflikt zwischen Anbieter und Kunden zu lösen und dadurch sicherzustellen, dass auch Zugriff besteht, auch wenn der Anbieter nicht mehr verfügbar ist oder z.B. die genutzte Software nicht mehr unterstützt.

Kunden-Service

Ein freundlicher Support der ihnen garantiert hilft ihre Anforderungen schnell und sicher umzusetzen.

ISO-zertifiziert

Standards die ein Höchstmaß an Vertraulichkeit, Integrität und Verfügbarkeit sicher stellen.

Flexible Vertragsgestaltung

DENIC bietet seinen Kunden individuelle Verträge die jederzeit flexibel mit Ihren Anforderungen wachsen.

Schnelle Uploads

“Fire and forget” immer sicher sein das Ihr Escrow Deposit up-to-date ist.

Moderne Übertragungstechnik schont ihre Zeit und verbessert die Sicherheit.

DENIC Digital Escrow Lösungen

Software Escrow

Schützen Sie ihre Software Anwendungen und den Source Code und prüfen Sie unsere Business Angebote für Kontinuität mit Software Escrow Lösungen.

Cloud Escrow

Schützen Sie Zugangsdaten von Cloud Software, den Source Code, ihre Datenbanken und Zugangsschlüssel und sichern Sie Kontinuität mit unseren Cloud Escrow Lösungen.

KI Escrow

Sichern Sie Indexierungen, Trainingsdaten, Algorithmen und genutzte Prompts und erfüllen Sie Compliance Anforderunen mit unseren Escrow Lösungen für künstliche Intelligenz.

Dokumenten Escrow

Schützen Sie Konstruktionspläne, Designvorlagen, Statistiken, Markting Material und Daten-Sammlungen mit unserem Daten & Dokumenten Escrow.

Key Escrow

Schützen Sie Zugangsschlüssel und Berechtigungen und stellen Sie mit unserer Key Escrow Lösung sicher, dass diese strikt getrennt von sonstigen Daten, aufbewahrt werden.

IP Escrow

Schützen Sie ihr geistiges Eigentum und sichern Sie Patente, digitale Bildkunst und Kompositionen, Rezepturen und ihre Markenwerte mit unseren Escrow Lösungen für Intellectual Properties (IP).

DENIC Digital Escrow Leistungen

Flexible Verträge

Genau das Richtige für Sie und Ihre Partner. Mit verschiedenen Verträgen reagieren wir auf unterschiedliche Anforderungen der angebotenen Escrow Lösungen.

Kunden-Service

DEINC Services hat eine Weiterempfehlungsrate von 4,9 (5 Punkteskala) bei Kunden. Unsere Service- und Supportteams helfen seit vielen Jahren bei allen Fragen rund um Digital Escrow.

International

DENIC Services hat jahrelange Erfahrung in der tagtäglichen Sicherung digitaler Daten. Zufriedene Kunden aus aller Welt nutzen den etablierten Data Escrow Service für obligatorische Daten-Deposits.

Deposits

Die eingelieferten Datenpakete, die Sie uns zu vertrauenswürdigen Händen überlassen, werden DSGVO konform innerhalb der EU auf sicherer IT-Infrastrutkur gespeicher

Upload Möglichkeiten

Wir untersützen flexible Uploadtechniken die sich einfach in ihre Entwicklungsumgebung integrieren lassen. Escrow-Uploads sind dadurch schnell und sicher erledigt. Jederzeit.

Verifikation

Sofortige Bestätigung für jeden Upload. Jeder Deposit-Upload erstellt einen Verifizierungsbericht für die Beteiligten mit Zeitstempel. So herrscht Klarheit über die hochgeladenen Einlieferungen.

Kunden sichern ihre Kontinuität,

mit DENIC Digital Escrow Services

DORA EU-Verordnung

Die Anforderungen des Digital Operational Resilience Act gemäß EU-Verordnung müssen Finanzdienstleister ab Januar 2025 umgesetzt haben. Unter anderem verpflichtet "Dora" zur Sicherstellung der IT-Verfügbarkeit zur Abwehr von IT-Risiken. DENIC Digital Escow Services sichert durch Treuhandhinterlegung digitaler Asstes ihre Business Continuity wenn es darauf ankommt.

- ✔ Software Escrow und Source Code Escrow

- ✔ Daten und Dokumenten Escrow

- ✔ Escrow der IAM mit Zugangsberechtigungen und -schlüsseln (Key Escrow)

- ✔ Locked Backup auch vollständiger Anwendungen

KRITIS und NIS-2

Wichtige Unternehmen als Teil der kritischen Infrastruktur (KRITIS) und wesentliche Unternehmen gemäß NIS-2 Verordnung hinterlegen große Teile ihrer Software-Infrastruktur und digitale Daten bei DENIC Services und stellen so eigene Kontinuität als auch die Kontinuität ihrer Kunden im Krisen- und Katastrophenfall sicher. Zur Anwendung kommen

- ✔ Software- und Source Code Escrow

- ✔ Daten und Dokumenten Escrow

- ✔ Hinterlegungsvereinbarungen für Zugangsschlüssel (Key Escrow)

- ✔ Locked Backup

EVB-IT

Start-ups sowie klein- und mittelständige Unternehmern verbessern ihre Wettbewerbsfähigkeit und Vertrauenswürdigkeit bei Ausschreibungen zur Beschaffung von IT durch öffentliche Institutionen. DENIC Services kennt die wachsende Bedeutung von Treuhandhinterlegungen in der Vertragsgestaltung gemäß EVB-IT und bietet kompetente Beratung von Anfang an.

- ✔ Software Escrow

- ✔ Source Code Escrow

- ✔ Cloud-Escrow SaaS

- ✔ Treuhandvereinbarungen für Zugangsschlüssel (Key Escrow)

EU AI Act und KI-Verordnung

DENIC Services unterstützt Unternehmen und Entwickler den KI Compliance Anforderungen nachkomnmen zu können. Schon heute sorgen wir für mehr Transparenz und Sicherheit im rasant wachsenden Markt für Künstliche Intelligenz. Das DENIC KI-Experten-Team rät schon in der Planungsphase einer KI-Anwendung den Treundhinterlegungsprozess zu berücksichtigen. Nur so lässt sich die gesamte Entstehungsgeschichte protokollieren. In jedem Fall ein entscheidender Vorteil.

- ✔ KI Escrow

- ✔ Source Code Escrow

- ✔ Daten und Dokumenten Escrow

Setzen Sie auf die Erfahrung der DENIC Services

Stefan Pattberg

„Seit unserem Bestehen kümmert sich die DENIC Services um den Schutz wertvoller Unternehmensdaten und von Geschäftsgeheimnissen. Mit Digital Escrow haben wir eine umfassende Lösung dafür. Als Geschäftsführer weiß ich es zu schätzen, wenn mir Compliance-Anforderungen leicht, online und ohne große Kopfschmerzen abgenommen werden.“

Daniel Kremer

"Ich bin als Chief Information Security Officer (CISO) bei der DENIC eG verantwortlich für das Informationssicherheits- und Business Continuitymanagement (ISMS/BCMS). Als tech. Dienstleister für die DENIC Services pflegen wir, auch über unsere Kernkompetenzen im Bereich TDL Registry und DNS als Betreiber kritischer Infrastruktur in Deutschland (KRITIS) hinaus, ein hohes Maß an Informationssicherheit."

Claudia Klukas

"Kundennähe und Kundenzufriedenheit sind für mich und mein Team selbstverständlich. Ich leite den Kunden-Support. Die Qualifikation unserer Mitarbeiter sicheren wir durch ständige Aus- und Weiterbildung und Teilnahme an Auditierungen. Wir freuen uns über jede Anfrage, Anregung und ein Feedback von Interessenten und unseren Kunden. Wir sind erst zufrieden wenn Sie es sind."

Jetzt mit DENIC Digital Escrow starten!

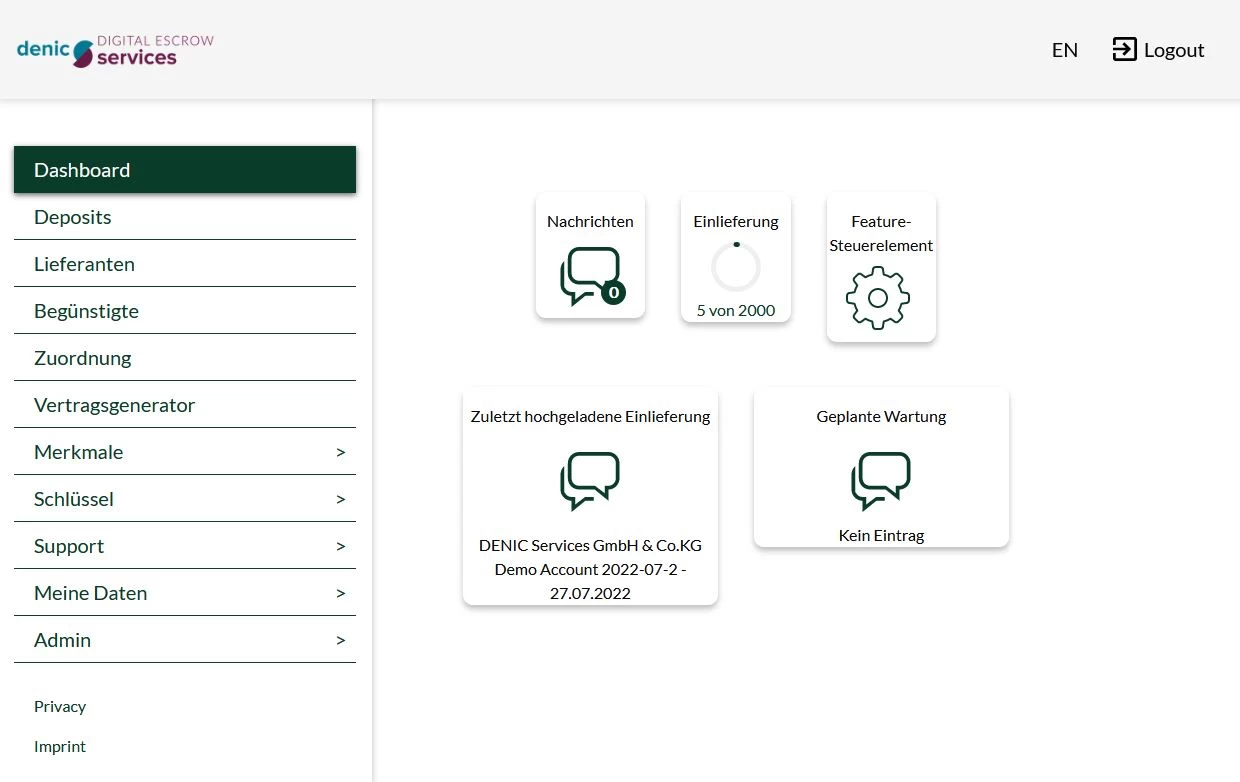

DENIC Digital Escrow Start

Laden sie ihre Lieferanten und Kunden ein und arbeiten Sie gemeinsam an ihren Vereinbarungen und ihren Deposits, um ihre digitalen Daten zu schützen.

➪ Schritt 1: Lernen Sie die Vorteile von DENIC Digital Escrow in einer persönlichen Demo kennen.

➪ Schritt 2: Wählen sie den Umfang der Leistungen und registrieren sie sich.

➪ Schritt 3: Laden sie ihr Team bzw. ihre Lieferanten dazu ein Daten zu hinterlegen.

Gesicherte Kontinuität

Alle Daten & Dokumente werden verschlüsselt aufbewahrt und im Falle eines Auslieferungsereignisses bereitgestellt.

✔ Geschützt gegen Ausfall

✔ Geschützt gegen Schadsoftware

✔ Gesichert im Katastrophenfall

Automatisierte Deposits

Integriert sich direkt in die Arbeitsabläufe von Entwicklern. Die Einlieferungen sind verschlüsselt und vollständig automatisiert.

✔ Hinterlegung der neuesten Versionen

✔ Verschlüsselt mit höchster Sicherheit

✔ Digitale Einlieferungen mit Zeitstempel

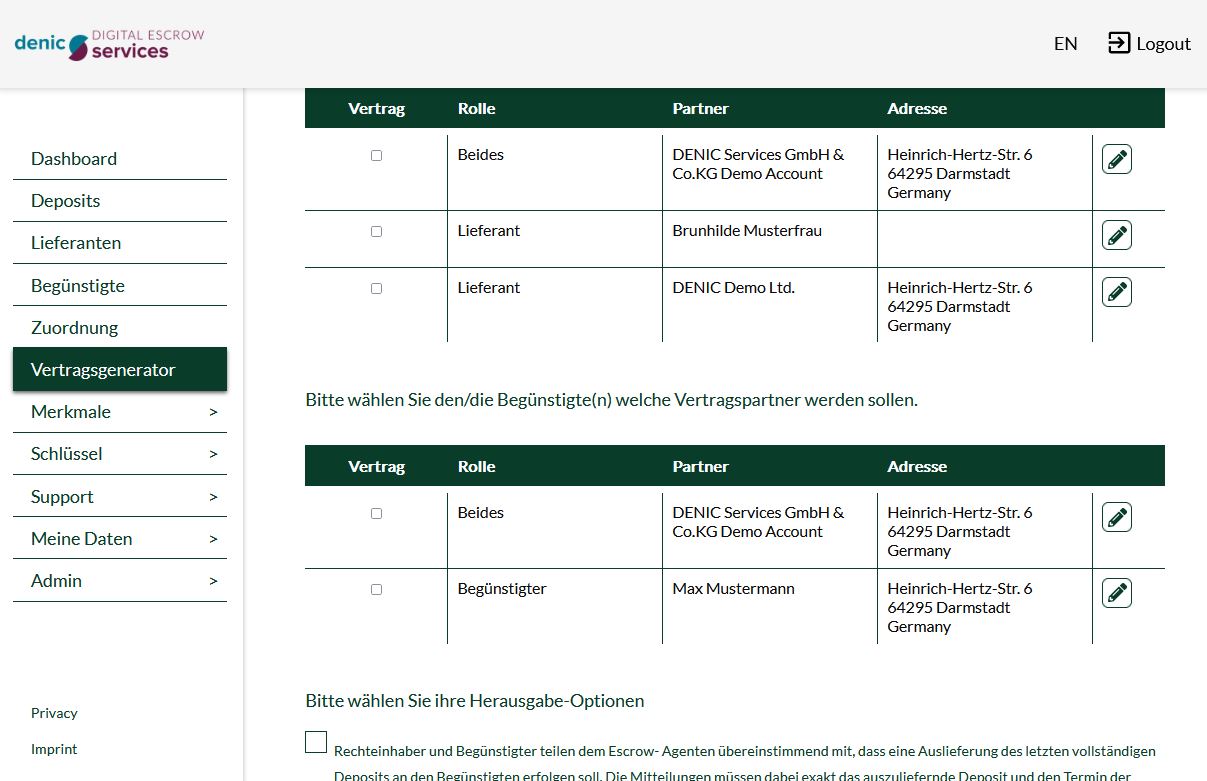

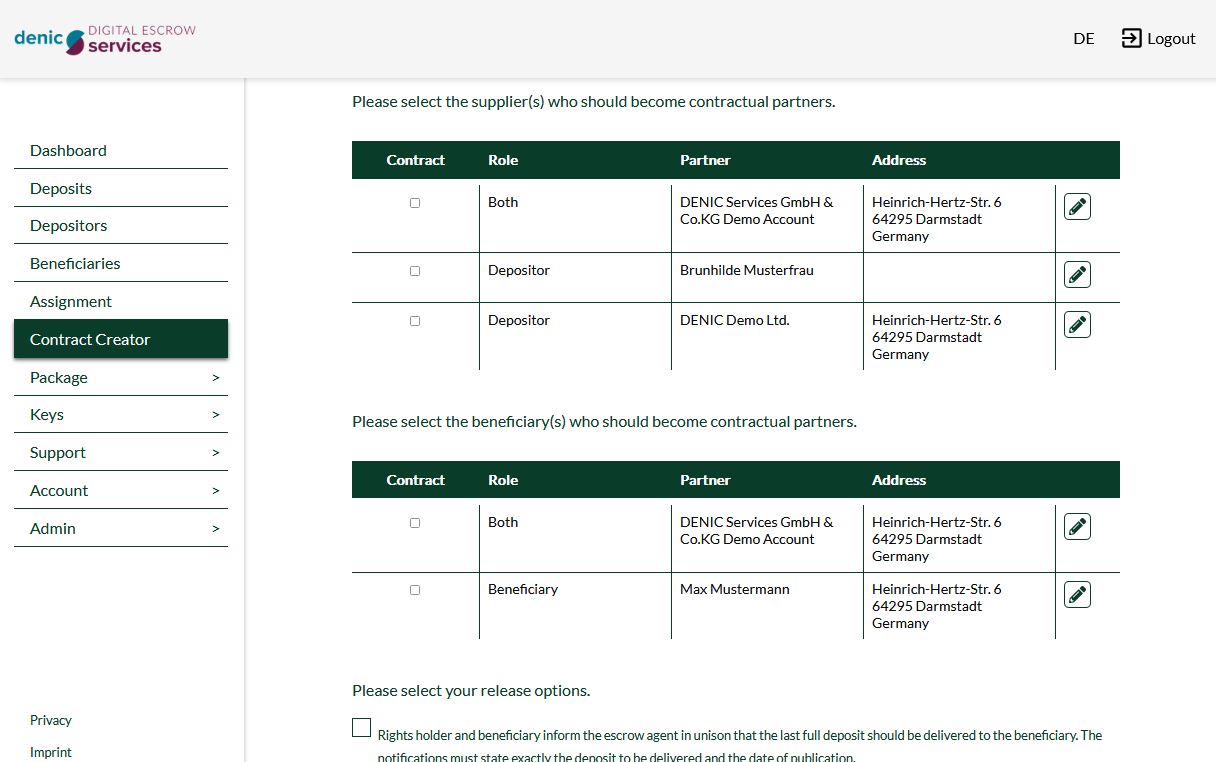

Einfache Vertragsgestaltung

Sichere Vertragsvereinbarungen inklusive. Sie erhalten einen Treuhandvertrag den wir gemeinsam anpassen.

✔ Mehrere Vertragsarten verfügbar

✔ Einfache und schnelle Abwicklung

✔ Anpassungen jederzeit möglich

Garantierte Auslieferung

Bei vorliegendem Auslieferungsereignis unterstützt unser Support rund um die Uhr an allen Wochentagen eine schnelle Daten-Übergabe.

✔ Eindeutige Verifizierung der Partner

✔ Gesicherte Schlüssel-Auslieferung

✔ 24/7 Untersützung durch den Support